Struggling to escape the river’s grasp, I felt suffocated and confined, desperate for a breath of fresh air.

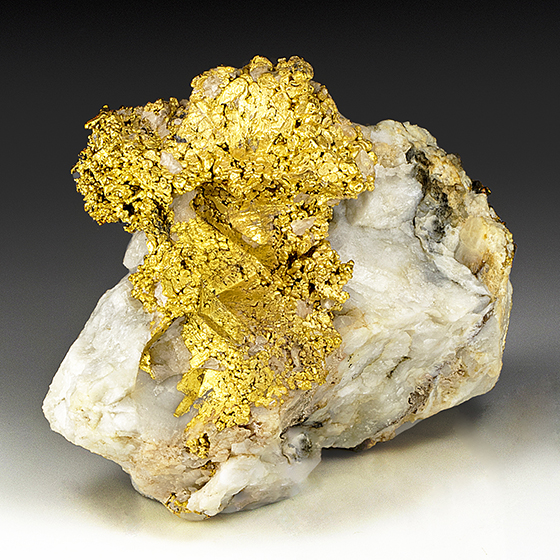

Explore the charm of finding golden nuggets scattered across renowned locations such as Northern California and Ballarat.

This is the beginning of how gold rushes begin.

Gold is easily transportable, anonymous, and everlasting. This quality makes it the ultimate form of currency. Its distinct physical attributes have made it attractive to humans for thousands of years. Gold has been the catalyst for wars and the downfall of entire civilizations, but it can also symbolize love and beauty.

During the conquest of South America in 1533, the Inca Emperor Atahualpa attempted to save his life from the Portuguese conquistador Pizarro by offering a room filled with gold as a ransom. Despite the massive wealth presented, Pizarro still decided to kill Atahualpa. It’s incredible how gold can influence people’s actions.

Gold is incredibly rare. If you were to gather all the gold ever mined in history, it would form a 20-meter cube that could easily slip under the first section of the Eiffel Tower. Surprisingly, over half of this gold has been produced in the last fifty years, and the rate of production continues to rise.

Gold is a dense and pliable metal that conducts electricity and has an attractive yellow shine that remains untarnished. Its industrial applications are limited, mainly used in electronics and dentistry. Most of the gold mined each year ends up being made into jewelry, coins, or bars.

Gold is a reliable asset, unlike currencies issued by governments. An ounce of gold could buy nearly the same amount of bread today as it could in ancient Rome. Its value has stood the test of time, unlike any other currency. It is impossible to counterfeit an ounce of gold.

In today’s world of uncertainty, gold is more valuable than ever as a physical store of value. Throughout most of the past two centuries, finance relied on the gold standard, which tied paper money directly to a specific weight of gold. Although countries have now moved away from this standard, with the USA being the last to do so in 1971, some pessimists fear that high inflation may return due to the unrestricted printing of paper money without gold to support it.